Financial Privacy Rule

PART 313—PRIVACY OF CONSUMER FINANCIAL INFORMATION

Authority: 15 U.S.C. 6801 et seq., 12 U.S.C. 5519.

Source: 65 FR 33677, May 24, 2000, unless otherwise noted.

§ 313.1 Purpose and scope.

-

Purpose: This part governs the treatment of nonpublic personal information about consumers by the financial institutions listed in paragraph (b) of this section. This part:

- Requires a financial institution in specified circumstances to provide notice to customers about its privacy policies and practices;

- Describes the conditions under which a financial institution may disclose nonpublic personal information about consumers to nonaffiliated third parties; and

- Provides a method for consumers to prevent a financial institution from disclosing that information to most nonaffiliated third parties by “opting out” of that disclosure, subject to the exceptions in § 313.13, 313.14, and 313.15.

-

Scope: This part applies only to nonpublic personal information about individuals who obtain financial products or services primarily for personal, family, or household purposes from the institutions listed below. This part does not apply to information about companies or about individuals who obtain financial products or services for business, commercial, or agricultural purposes. This part applies to those “financial institutions” over which the Federal Trade Commission (“Commission”) has rulemaking authority pursuant to section 504(a)(1)(C) of the Gramm-Leach-Bliley Act. An entity is a “financial institution” if its business is engaging in an activity that is financial in nature or incidental to such financial activities as described in section 4(k) of the Bank Holding Company Act of 1956, 12 U.S.C. 1843(k), which incorporates activities enumerated by the Federal Reserve Board in 12 CFR 225.28 and 225.86.

- The “financial institutions” subject to the Commission's rulemaking authority are any persons described in 12 U.S.C. 5519 that are predominantly engaged in the sale and servicing of motor vehicles, the leasing and servicing of motor vehicles, or both. They are referred to in this part as “You.”

- Excluded from the coverage of this part are motor vehicle dealers described in 12 U.S.C. 5519(b) that directly extend to consumers retail credit or retail leases involving motor vehicles in which the contract governing such extension of retail credit or retail leases is not routinely assigned to an unaffiliated third-party finance or leasing source.

[65 FR 33677, May 24, 2000, as amended at 86 FR 70025, Dec. 9, 2021]

§ 313.2 Model privacy form and examples.

-

Model privacy form: Use of the model privacy form in Appendix A of this part, consistent with the instructions in Appendix A, constitutes compliance with the notice content requirements of §§ 313.6 and 313.7 of this part, although use of the model privacy form is not required.

-

Examples: The examples in this part are not exclusive. Compliance with an example, to the extent applicable, constitutes compliance with this part.

[74 FR 62965, Dec. 1, 2009]

§ 313.3 Definitions

As used in this part, unless the context requires otherwise:

-

Affiliate means any company that controls, is controlled by, or is under common control with another company.

-

Clear and conspicuous means that a notice is reasonably understandable and designed to call attention to the nature and significance of the information in the notice.

- Examples:

- Reasonably understandable:

- Present the information in the notice in clear, concise sentences, paragraphs, and sections.

- Use short explanatory sentences or bullet lists whenever possible.

- Use definite, concrete, everyday words and active voice whenever possible.

- Avoid multiple negatives.

- Avoid legal and highly technical business terminology whenever possible.

- Avoid explanations that are imprecise and readily subject to different interpretations.

- Designed to call attention:

- Use a plain-language heading to call attention to the notice.

- Use a typeface and type size that are easy to read.

- Provide wide margins and ample line spacing.

- Use boldface or italics for key words.

- In a form that combines your notice with other information, use distinctive type size, style, and graphic devices, such as shading or sidebars, when you combine your notice with other information.

- Notices on websites:

- If you provide a notice on a web page, you design your notice to call attention to the nature and significance of the information in it if you use text or visual cues to encourage scrolling down the page if necessary to view the entire notice.

- Ensure that other elements on the web page (such as text, graphics, hyperlinks, or sound) do not distract attention from the notice.

- You either:

- Place the notice on a screen that consumers frequently access, such as a page on which transactions are conducted.

- Place a link on a screen that consumers frequently access, such as a page on which transactions are conducted, that connects directly to the notice and is labeled appropriately to convey the importance, nature and relevance of the notice.

- Reasonably understandable:

- Examples:

-

Collect means to obtain information that you organize or can retrieve by the name of an individual or by identifying number, symbol, or other identifying particular assigned to the individual, irrespective of the source of the underlying information.

-

Company means any corporation, limited liability company, business trust, general or limited partnership, association, or similar organization.

-

Consumer means an individual who obtains or has obtained a financial product or service from you that is to be used primarily for personal, family, or household purposes, or that individual’s legal representative.

- For example:

- An individual who applies to you for credit for personal, family, or household purposes is a consumer of a financial service, regardless of whether the credit is extended.

- An individual who provides nonpublic personal information to you in order to obtain a determination about whether he or she may qualify for a loan to be used primarily for personal, family, or household purposes is a consumer of a financial service, regardless of whether the loan is extended.

- If you hold ownership or servicing rights to an individual’s loan that is used primarily for personal, family, or household purposes, the individual is your consumer, even if you hold those rights in conjunction with one or more other institutions. (The individual is also a consumer with respect to the other financial institutions involved.) An individual who has a loan in which you have ownership or servicing rights is your consumer, even if you, or another institution with those rights, hire an agent to collect on the loan.

- An individual who is a consumer of another financial institution is not your consumer solely because you act as agent for, or provide processing or other services to, that financial institution.

- An individual is not your consumer solely because he or she is a participant or a beneficiary of an employee benefit plan that you sponsor or for which you act as a trustee or fiduciary.

- For example:

-

Consumer reporting agency has the same meaning as in section 603(f) of the Fair Credit Reporting Act (15 U.S.C. 1681a(f)).

-

Control of a company means:

- Ownership, control, or power to vote 25 percent or more of the outstanding shares of any class of voting security of the company, directly or indirectly, or acting through one or more other persons;

- Control in any manner over the election of a majority of the directors, trustees, or general partners (or individuals exercising similar functions) of the company; or

- The power to exercise, directly or indirectly, a controlling influence over the management or policies of the company.

-

Customer means a consumer who has a customer relationship with you.

-

Customer relationship means a continuing relationship between a consumer and you under which you provide one or more financial products or services to the consumer that are to be used primarily for personal, family, or household purposes.

- For example:

- Continuing relationship: A consumer has a continuing relationship with you if the consumer:

- Has a credit or investment account with you;

- Obtains a loan from you;

- Purchases an insurance product from you;

- Enters into an agreement or understanding with you whereby you undertake to arrange or broker a home mortgage loan, or credit to purchase a vehicle, for the consumer;

- Enters into a lease of personal property on a non-operating basis with you;

- Has a loan for which you own the servicing rights.

- No continuing relationship: A consumer does not, however, have a continuing relationship with you if:

- The consumer obtains a financial product or service from you only in isolated transactions, such as cashing a check with you or making a wire transfer through you;

- You sell the consumer’s loan and do not retain the rights to service that loan; or

- The consumer obtains one-time personal appraisal services from you.

- Continuing relationship: A consumer has a continuing relationship with you if the consumer:

- For example:

- Federal functional regulator means:

- The Board of Governors of the Federal Reserve System;

- The Office of the Comptroller of the Currency;

- The Board of Directors of the Federal Deposit Insurance Corporation;

- The National Credit Union Administration Board; and

- The Securities and Exchange Commission.

- Financial institution means any institution the business of which is engaging in an activity that is financial in nature or incidental to such financial activities as described in section 4(k) of the Bank Holding Company Act of 1956, 12 U.S.C. 1843(k). An institution that is significantly engaged in financial activities, or significantly engaged in activities incidental to such financial activities, is a financial institution.

- An example of a financial institution is an automobile dealership that, as a usual part of its business, leases automobiles on a non-operating basis for longer than 90 days. It is considered a financial institution with respect to its leasing business because leasing personal property on a non-operating basis, where the initial term of the lease is at least 90 days, is a financial activity listed in 12 CFR 225.28(b)(3) and referenced in section 4(k)(4)(F) of the Bank Holding Company Act.

- Financial institution does not include entities that engage in financial activities but that are not significantly engaged in those financial activities.

- An example of entities that are not significantly engaged in financial activities is a motor vehicle dealer, which is not a financial institution merely because it accepts payment in the form of cash, checks, or credit cards that it did not issue.

- Financial product or service means any product or service that a financial holding company could offer by engaging in a financial activity under section 4(k) of the Bank Holding Company Act of 1956 (12 U.S.C. 1843(k)).

- Financial service includes your evaluation or brokerage of information that you collect in connection with a request or an application from a consumer for a financial product or service.

- Nonaffiliated third party means any person except:

- Your affiliate; or

- A person employed jointly by you and any company that is not your affiliate (but nonaffiliated third party includes the other company that jointly employs the person).

- Nonaffiliated third party includes any company that is an affiliate by virtue of your or your affiliate’s direct or indirect ownership or control of the company in conducting merchant banking or investment banking activities of the type described in section 4(k)(4)(H) or insurance company investment activities of the type described in section 4(k)(4)(I) of the Bank Holding Company Act (12 U.S.C. 1843(k)(4)(H) and (I)).

- Nonpublic personal information means:

- Personally identifiable financial information; and

- Any list, description, or other grouping of consumers (and publicly available information pertaining to them) that is derived using any personally identifiable financial information that is not publicly available.

- Nonpublic personal information does not include:

- Publicly available information, except as included on a list described in paragraph (n)(1)(ii) of this section; or

- Any list, description, or other grouping of consumers (and publicly available information pertaining to them) that is derived without using any personally identifiable financial information that is not publicly available.

- Examples of lists:

- Nonpublic personal information includes any list of individuals’ names and street addresses that is derived in whole or in part using personally identifiable financial information (that is not publicly available), such as account numbers.

- Nonpublic personal information does not include any list of individuals’ names and addresses that contains only publicly available information, is not derived, in whole or in part, using personally identifiable financial information that is not publicly available, and is not disclosed in a manner that indicates that any of the individuals on the list is a consumer of a financial institution.

- Personally identifiable financial information means any information:

- A consumer provides to you to obtain a financial product or service from you;

- About a consumer resulting from any transaction involving a financial product or service between you and a consumer; or

- You otherwise obtain about a consumer in connection with providing a financial product or service to that consumer.

- Examples:

- Information included: Personally identifiable financial information includes:

- Information a consumer provides to you on an application to obtain a loan, credit card, or other financial product or service;

- Account balance information, payment history, overdraft history, and credit or debit card purchase information;

- The fact that an individual is or has been one of your customers or has obtained a financial product or service from you;

- Any information about your consumer if it is disclosed in a manner that indicates that the individual is or has been your consumer;

- Any information that a consumer provides to you or that you or your agent otherwise obtain in connection with collecting on, or servicing, a credit account;

- Any information you collect through an Internet “cookie” (an information collecting device from a web server); and

- Information from a consumer report.

- Information not included: Personally identifiable financial information does not include:

- A list of names and addresses of customers of an entity that is not a financial institution; and

- Information that does not identify a consumer, such as aggregate information or blind data that does not contain personal identifiers such as account numbers, names, or addresses.

- Information included: Personally identifiable financial information includes:

- Publicly available information means any information that you have a reasonable basis to believe is lawfully made available to the general public from:

- Federal, State, or local government records;

- Widely distributed media; or

- Disclosures to the general public that are required to be made by Federal, State, or local law.

- Reasonable basis: You have a reasonable basis to believe that information is lawfully made available to the general public if you have taken steps to determine:

- That the information is of the type that is available to the general public; and

- Whether an individual can direct that the information not be made available to the general public and, if so, that your consumer has not done so.

- Examples:

- Government records: Publicly available information in government records includes information in government real estate records and security interest filings.

- Widely distributed media: Publicly available information from widely distributed media includes information from a telephone book, a television or radio program, a newspaper, or a website that is available to the general public on an unrestricted basis. A website is not restricted merely because an Internet service provider or a site operator requires a fee or a password, so long as access is available to the general public.

- Reasonable basis:

- You have a reasonable basis to believe that mortgage information is lawfully made available to the general public if you have determined that the information is of the type included on the public record in the jurisdiction where the mortgage would be recorded.

- You have a reasonable basis to believe that an individual’s telephone number is lawfully made available to the general public if you have located the telephone number in the telephone book or the consumer has informed you that the telephone number is not unlisted.

- You includes each “financial institution” over which the Commission has rulemaking authority pursuant to section 504(a)(1)(C) of the Gramm-Leach-Bliley Act (15 U.S.C. 6804(a)(1)(C)).

[65 FR 33677, May 24, 2000, as amended at 86 FR 70025, Dec. 9, 2021]

Subpart A—Privacy and Opt Out Notices

§ 313.4 Initial privacy notice to consumers required

-

Initial notice requirement. You must provide a clear and conspicuous notice that accurately reflects your privacy policies and practices to:

- Customer: An individual who becomes your customer, not later than when you establish a customer relationship, except as provided in paragraph (e) of this section.

- Consumer: A consumer, before you disclose any nonpublic personal information about the consumer to any non-affiliated third party, if you make such a disclosure other than as authorized by §313.14 and 313.15.

-

When initial notice to a consumer is not required: You are not required to provide an initial notice to a consumer under paragraph (a) of this section if:

-

When you establish a customer relationship:

- General rule: You establish a customer relationship when you and the consumer enter into a continuing relationship.

- Special rule for loans: You establish a customer relationship with a consumer when you originate a loan to the consumer for personal, family, or household purposes. If you subsequently transfer the servicing rights to that loan to another financial institution, the customer relationship transfers with the servicing rights.

- Examples:

- Examples of establishing a customer relationship: You establish a customer relationship when the consumer:

- Executes the contract to obtain credit from you or purchase insurance from you.

- Executes the lease for personal property with you.

- Examples of loan rule: You establish a customer relationship with a consumer who obtains a loan for personal, family, or household purposes when you:

- Originate the loan to the consumer and retain the servicing rights.

- Purchase the servicing rights to the consumer's loan.

- Examples of establishing a customer relationship: You establish a customer relationship when the consumer:

-

Existing customers: When an existing customer obtains a new financial product or service from you that is to be used primarily for personal, family, or household purposes, you satisfy the initial notice requirements of paragraph (a) of this section as follows:

- You may provide a revised privacy notice, under § 313.8, that covers the customer's new financial product or service.

- If the initial, revised, or annual notice that you most recently provided to that customer was accurate with respect to the new financial product or service, you do not need to provide a new privacy notice under paragraph (a) of this section.

-

Exceptions to allow subsequent delivery of notice:

- General: You may provide the initial notice required by paragraph (a)(1) within a reasonable time after you establish a customer relationship if:

- Establishing the customer relationship is not at the customer's election.

- Providing notice not later than when you establish a customer relationship would substantially delay the customer's transaction and the customer agrees to receive the notice at a later time.

- Examples of exceptions:

- Substantial delay of customer's transaction: Providing notice not later than when you establish a customer relationship would substantially delay the customer's transaction when you and the individual agree over the telephone to enter into a customer relationship involving prompt delivery of the financial product or service.

- No substantial delay of customer's transaction: Providing notice not later than when you establish a customer relationship would not substantially delay the customer's transaction when the relationship is initiated in person at your office or through other means by which the customer may view the notice, such as through a website.

- General: You may provide the initial notice required by paragraph (a)(1) within a reasonable time after you establish a customer relationship if:

-

Delivery: When you are required to deliver an initial privacy notice by this section, you must deliver it according to § 313.9. If you use a short-form initial notice for non-customers according to § 313.6(d), you may deliver your privacy notice according to § 313.6(d)(3).

[65 FR 33677, May 24, 2000, as amended at 86 FR 70026, Dec. 9, 2021]

§ 313.5 Annual privacy notice to customers required

-

In general

-

General rule

Except as provided by paragraph (e) of this section, you must provide a clear and conspicuous notice to customers that accurately reflects your privacy policies and practices not less than annually during the continuation of the customer relationship. "Annually" means at least once in any period of 12 consecutive months during which that relationship exists. You may define the 12-consecutive-month period, but you must apply it to the customer on a consistent basis. -

Example

You provide a notice annually if you define the 12-consecutive-month period as a calendar year and provide the annual notice to the customer once in each calendar year following the calendar year in which you provided the initial notice. For example, if a customer opens an account on any day of year 1, you must provide an annual notice to that customer by December 31 of year 2.

-

-

Termination of customer relationship

-

Termination of customer relationship

You are not required to provide an annual notice to a former customer. -

Examples

Your customer becomes a former customer when:- In the case of a closed-end loan, the customer pays the loan in full, you charge off the loan, or you sell the loan without retaining servicing rights.

- In the case of mortgage or vehicle loan brokering services, your customer has obtained a loan through you (and you no longer provide any statements or notices to the customer concerning that relationship), or has ceased using your services for such purposes.

- In cases where there is no definitive time at which the customer relationship has terminated, you have not communicated with the customer about the relationship for a period of 12 consecutive months, other than to provide annual privacy notices or promotional material.

-

-

Special rule for loans

If you do not have a customer relationship with a consumer under the special rule for loans in § 313.4(c)(2), then you need not provide an annual notice to that consumer under this section. -

Delivery

When you are required to deliver an annual privacy notice by this section, you must deliver it according to § 313.9. -

Exception to annual privacy notice requirement

-

When exception available

You are not required to deliver an annual privacy notice if you:- Provide nonpublic personal information to nonaffiliated third parties only in accordance with the provisions of § 313.13, § 313.14, or § 313.15; and

- Have not changed your policies and practices with regard to disclosing nonpublic personal information from the policies and practices that were disclosed to the customer under § 313.6(a)(2) through (5) and (9) in the most recent privacy notice provided pursuant to this part.

-

Delivery of annual privacy notice after financial institution no longer meets requirements for exception

If you have been excepted from delivering an annual privacy notice pursuant to paragraph (e)(1) of this section and change your policies or practices in such a way that you no longer meet the requirements for that exception, you must comply with paragraph (e)(2)(i) or (ii) of this section, as applicable.-

Changes preceded by a revised privacy notice

If you no longer meet the requirements of paragraph (e)(1) of this section because you change your policies or practices in such a way that § 313.8 requires you to provide a revised privacy notice, you must provide an annual privacy notice in accordance with the timing requirement in paragraph (a) of this section, treating the revised privacy notice as an initial privacy notice. -

Changes not preceded by a revised privacy notice

If you no longer meet the requirements of paragraph (e)(1) of this section because you change your policies or practices in such a way that § 313.8 does not require you to provide a revised privacy notice, you must provide an annual privacy notice within 100 days of the change in your policies or practices that causes you to no longer meet the requirement of paragraph (e)(1).

-

-

Examples

- You change your policies and practices in such a way that you no longer meet the requirements of paragraph (e)(1) of this section effective April 1 of year 1. Assuming you define the 12-consecutive-month period pursuant to paragraph (a) of this section as a calendar year, if you were required to provide a revised privacy notice under § 313.8 and you provided that notice on March 1 of year 1, you must provide an annual privacy notice by December 31 of year 2. If you were not required to provide a revised privacy notice under § 313.8, you must provide an annual privacy notice by July 9 of year 1.

- You change your policies and practices in such a way that you no longer meet the requirements of paragraph (e)(1) of this section, and so provide an annual notice to your customers. After providing the annual notice to your customers, you once again meet the requirements of paragraph (e)(1) of this section for an exception to the annual notice requirement. You do not need to provide additional annual notice to your customers until such time as you no longer meet the requirements of paragraph (e)(1) of this section.

-

[65 FR 33677, May 24, 2000, as amended at 86 FR 70026, Dec. 9, 2021]

§ 313.6 Information to be included in privacy notices

-

General rule

The initial, annual, and revised privacy notices that you provide under § 313.4, 313.5, and 313.8 must include each of the following items of information that applies to you or to the consumers to whom you send your privacy notice, in addition to any other information you wish to provide:- The categories of nonpublic personal information that you collect;

- The categories of nonpublic personal information that you disclose;

- The categories of affiliates and nonaffiliated third parties to whom you disclose nonpublic personal information, other than those parties to whom you disclose information under § 313.14 and 313.15;

- The categories of nonpublic personal information about your former customers that you disclose and the categories of affiliates and nonaffiliated third parties to whom you disclose nonpublic personal information about your former customers, other than those parties to whom you disclose information under § 313.14 and 313.15;

- If you disclose nonpublic personal information to a nonaffiliated third party under § 313.13 (and no exception under § 313.14 or § 313.15 applies to that disclosure), a separate statement of the categories of information you disclose and the categories of third parties with whom you have contracted;

- An explanation of the consumer's right under § 313.10(a) to opt out of the disclosure of nonpublic personal information to nonaffiliated third parties, including the method(s) by which the consumer may exercise that right at that time;

- Any disclosures that you make under section 603(d)(2)(A)(iii) of the Fair Credit Reporting Act (15 U.S.C. 1681a(d)(2)(A)(iii)) (that is, notices regarding the ability to opt out of disclosures of information among affiliates);

- Your policies and practices with respect to protecting the confidentiality and security of nonpublic personal information; and

- Any disclosure that you make under paragraph (b) of this section.

-

Description of nonaffiliated third parties subject to exceptions

If you disclose nonpublic personal information to third parties as authorized under § 313.14 and 313.15, you are not required to list those exceptions in the initial or annual privacy notices required by §§ 313.4 and 313.5. When describing the categories with respect to those parties, it is sufficient to state that you make disclosures to other nonaffiliated companies for your everyday business purposes, such as to process transactions, maintain account(s), respond to court orders and legal investigations, or report to credit bureaus. -

Examples

-

Categories of nonpublic personal information that you collect

You satisfy the requirement to categorize the nonpublic personal information that you collect if you list the following categories, as applicable:- Information from the consumer;

- Information about the consumer's transactions with you or your affiliates;

- Information about the consumer's transactions with nonaffiliated third parties; and

- Information from a consumer reporting agency.

-

Categories of nonpublic personal information you disclose

- You satisfy the requirement to categorize the nonpublic personal information that you disclose if you list the categories described in paragraph (e)(1) of this section, as applicable, and a few examples to illustrate the types of information in each category.

- If you reserve the right to disclose all of the nonpublic personal information about consumers that you collect, you may simply state that fact without describing the categories or examples of the nonpublic personal information you disclose.

-

Categories of affiliates and nonaffiliated third parties to whom you disclose

You satisfy the requirement to categorize the affiliates and nonaffiliated third parties to whom you disclose nonpublic personal information if you list them using the following categories, as applicable, and a few applicable examples to illustrate the significant types of third parties covered in each category.- Financial service providers, followed by illustrative examples such as mortgage bankers, securities broker-dealers, and insurance agents.

- Non-financial companies, followed by illustrative examples such as retailers, magazine publishers, airlines, and direct marketers.

- Others, followed by examples such as nonprofit organizations.

-

Disclosures under exception for service providers and joint marketers

If you disclose nonpublic personal information under the exception in § 313.13 to a nonaffiliated third party to market products or services that you offer alone or jointly with another financial institution, you satisfy the disclosure requirement of paragraph (a)(5) of this section if you:- List the categories of nonpublic personal information you disclose, using the same categories and examples you used to meet the requirements of paragraph (a)(2) of this section, as applicable; and

- State whether the third party is:

- A service provider that performs marketing services on your behalf or on behalf of you and another financial institution; or

- A financial institution with whom you have a joint marketing agreement.

-

Simplified notices

If you do not disclose, and do not wish to reserve the right to disclose, nonpublic personal information about customers or former customers to affiliates or nonaffiliated third parties except as authorized under § 313.14 and 313.15, you may simply state that fact, in addition to the information you must provide under paragraphs (a)(1), (a)(8), (a)(9), and (b) of this section. -

Confidentiality and security

You describe your policies and practices with respect to protecting the confidentiality and security of nonpublic personal information if you do both of the following:- Describe in general terms who is authorized to have access to the information; and

- State whether you have security practices and procedures in place to ensure the confidentiality of the information in accordance with your policy. You are not required to describe technical information about the safeguards you use.

-

-

Short-form initial notice with opt out notice for non-customers

-

You may satisfy the initial notice requirements in §§ 313.4(a)(2), 313.7(b), and 313.7(c) for a consumer who is not a customer by providing a short-form initial notice at the same time as you deliver an opt out notice as required in § 313.7.

-

A short-form initial notice must:

- Be clear and conspicuous;

- State that your privacy notice is available upon request; and

- Explain a reasonable means by which the consumer may obtain that notice.

-

You must deliver your short-form initial notice according to § 313.9. You are not required to deliver your privacy notice with your short-form initial notice. You instead may simply provide the consumer a reasonable means to obtain your privacy notice. If a consumer who receives your short-form notice requests your privacy notice, you must deliver your privacy notice according to § 313.9.

-

Examples of obtaining privacy notice

- You provide a reasonable means by which a consumer may obtain a copy of your privacy notice if you:

- Provide a toll-free telephone number that the consumer may call to request the notice; or

- For a consumer who conducts business in person at your office, maintain copies of the notice on hand that you provide to the consumer immediately upon request.

- You provide a reasonable means by which a consumer may obtain a copy of your privacy notice if you:

-

-

Future disclosures

- Your notice may include:

- Categories of nonpublic personal information that you reserve the right to disclose in the future, but do not currently disclose; and

- Categories of affiliates or nonaffiliated third parties to whom you reserve the right in the future to disclose, but to whom you do not currently disclose, nonpublic personal information.

- Your notice may include:

-

Model privacy form

Pursuant to § 313.2(a) of this part, a model privacy form that meets the notice content requirements of this section is included in appendix A of this part.

[65 FR 33677, May 24, 2000, as amended at 74 FR 62965, Dec. 1, 2009]

§ 313.7 Form of opt out notice to consumers; opt out methods

-

Form of opt out notice

- If you are required to provide an opt out notice under § 313.10(a), you must provide a clear and conspicuous notice to each of your consumers that accurately explains the right to opt out under that section. The notice must state:

- That you disclose or reserve the right to disclose nonpublic personal information about your consumer to a nonaffiliated third party;

- That the consumer has the right to opt out of that disclosure; and

- A reasonable means by which the consumer may exercise the opt out right.

- If you are required to provide an opt out notice under § 313.10(a), you must provide a clear and conspicuous notice to each of your consumers that accurately explains the right to opt out under that section. The notice must state:

-

Examples

-

Adequate opt out notice

You provide adequate notice that the consumer can opt out of the disclosure of nonpublic personal information to a nonaffiliated third party if you:- Identify all of the categories of nonpublic personal information that you disclose or reserve the right to disclose, and all of the categories of nonaffiliated third parties to which you disclose the information, as described in § 313.6(a)(2) and (3), and state that the consumer can opt out of the disclosure of that information; and

- Identify the financial products or services that the consumer obtains from you, either singly or jointly, to which the opt out direction would apply.

-

Reasonable opt out means

You provide a reasonable means to exercise an opt out right if you:- Designate check-off boxes in a prominent position on the relevant forms with the opt out notice;

- Include a reply form that includes the address to which the form should be mailed;

- Provide an electronic means to opt out, such as a form that can be sent via electronic mail or a process at your website, if the consumer agrees to the electronic delivery of information; or

- Provide a toll-free telephone number that consumers may call to opt out.

-

Unreasonable opt out means

You do not provide a reasonable means of opting out if:- The only means of opting out is for the consumer to write his or her own letter to exercise that opt out right; or

- The only means of opting out as described in any notice subsequent to the initial notice is to use a check-off box that you provided with the initial notice but did not include with the subsequent notice.

-

Specific opt out means

You may require each consumer to opt out through a specific means, as long as that means is reasonable for that consumer.

-

-

Same form as initial notice permitted

You may provide the opt out notice together with or on the same written or electronic form as the initial notice you provide in accordance with § 313.4. -

Initial notice required when opt out notice delivered subsequent to initial notice

If you provide the opt out notice later than required for the initial notice in accordance with § 313.4, you must also include a copy of the initial notice with the opt out notice in writing or, if the consumer agrees, electronically. -

Joint relationships

- If two or more consumers jointly obtain a financial product or service from you, you may provide a single opt out notice, unless one or more of those consumers requests a separate opt out notice. Your opt out notice must explain how you will treat an opt out direction by a joint consumer.

- Any of the joint consumers may exercise the right to opt out. You may either:

- Treat an opt out direction by a joint consumer as applying to all of the associated joint consumers; or

- Permit each joint consumer to opt out separately.

- If you permit each joint consumer to opt out separately, you must permit one of the joint consumers to opt out on behalf of all of the joint consumers.

- You may not require all joint consumers to opt out before you implement any opt out direction.

- Example

If John and Mary have a joint credit card account with you and arrange for you to send statements to John's address, you may do any of the following, but you must explain in your opt out notice which opt out policy you will follow:- Send a single opt out notice to John's address, but you must accept an opt out direction from either John or Mary.

- Treat an opt out direction by either John or Mary as applying to the entire account. If you do so, and John opts out, you may not require Mary to opt out as well before implementing John's opt out direction.

- Permit John and Mary to make different opt out directions. If you do so:

- You must permit John and Mary to opt out for each other;

- If both opt out, you must permit both to notify you in a single response (such as on a form or through a telephone call); and

- If John opts out and Mary does not, you may only disclose nonpublic personal information about Mary, but not about John and not about John and Mary jointly.

-

Time to comply with opt out

You must comply with a consumer's opt out direction as soon as reasonably practicable after you receive it. -

Continuing right to opt out

A consumer may exercise the right to opt out at any time. -

Duration of consumer's opt out direction

- A consumer's direction to opt out under this section is effective until the consumer revokes it in writing or, if the consumer agrees, electronically.

- When a customer relationship terminates, the customer's opt out direction continues to apply to the nonpublic personal information that you collected during or related to that relationship. If the individual subsequently establishes a new customer relationship with you, the opt out direction that applied to the former relationship does not apply to the new relationship.

-

Delivery

When you are required to deliver an opt out notice by this section, you must deliver it according to § 313.9. -

Model privacy form

Pursuant to § 313.2(a) of this part, a model privacy form that meets the notice content requirements of this section is included in appendix A of this part.

[65 FR 33677, May 24, 2000, as amended at 74 FR 62966, Dec. 1, 2009]

§ 313.8 Revised privacy notice

-

General rule

You must not, directly or through any affiliate, disclose any nonpublic personal information about a consumer to a nonaffiliated third party other than as described in the initial notice provided to that consumer under § 313.4, unless:- You have provided to the consumer a clear and conspicuous revised notice that accurately describes your policies and practices;

- You have provided to the consumer a new opt-out notice;

- You have given the consumer a reasonable opportunity, before disclosing the information to the nonaffiliated third party, to opt out of the disclosure; and

- The consumer does not opt out.

-

Examples

- You must provide a revised notice before you:

- Disclose a new category of nonpublic personal information to any nonaffiliated third party;

- Disclose nonpublic personal information to a new category of nonaffiliated third party; or

- Disclose nonpublic personal information about a former customer to a nonaffiliated third party if that former customer has not had the opportunity to exercise an opt-out right regarding that disclosure.

- A revised notice is not required if you disclose nonpublic personal information to a new nonaffiliated third party that was adequately described in your prior notice.

- You must provide a revised notice before you:

-

Delivery

When you are required to deliver a revised privacy notice by this section, you must deliver it according to § 313.9.

§ 313.9 Delivering privacy and opt-out notices

-

How to provide notices

You must provide any privacy notices and opt-out notices, including short-form initial notices, so that each consumer can reasonably be expected to receive actual notice in writing or, if the consumer agrees, electronically. -

Examples of reasonable expectation of actual notice

You may reasonably expect that a consumer will receive actual notice if you:- Hand-deliver a printed copy of the notice to the consumer;

- Mail a printed copy of the notice to the last known address of the consumer;

- For the consumer who conducts transactions electronically, clearly and conspicuously post the notice on the electronic site and require the consumer to acknowledge receipt of the notice as a necessary step to obtaining a particular financial product or service;

- For an isolated transaction with the consumer, such as an ATM transaction, post the notice on the ATM screen and require the consumer to acknowledge receipt of the notice as a necessary step to obtaining the particular financial product or service.

-

Examples of unreasonable expectation of actual notice

You may not reasonably expect that a consumer will receive actual notice if you:- Only post a sign in your branch or office or generally publish advertisements of your privacy policies and practices;

- Send the notice via electronic mail to a consumer who does not obtain a financial product or service from you electronically.

-

Annual notices only

You may reasonably expect that a customer will receive actual notice of your annual privacy notice if:- The customer uses your website to access financial products and services electronically and agrees to receive notices at the website and you post your current privacy notice continuously in a clear and conspicuous manner on the website; or

- The customer has requested that you refrain from sending any information regarding the customer relationship, and your current privacy notice remains available to the customer upon request.

-

Oral description of notice insufficient

You may not provide any notice required by this part solely by orally explaining the notice, either in person or over the telephone. -

Retention or accessibility of notices for customers

- For customers only, you must provide the initial notice required by § 313.4(a)(1), the annual notice required by § 313.5(a), and the revised notice required by § 313.8 so that the customer can retain them or obtain them later in writing or, if the customer agrees, electronically.

- Examples of retention or accessibility

You provide a privacy notice to the customer so that the customer can retain it or obtain it later if you:- Hand-deliver a printed copy of the notice to the customer;

- Mail a printed copy of the notice to the last known address of the customer; or

- Make your current privacy notice available on a website (or a link to another website) for the customer who obtains a financial product or service electronically and agrees to receive the notice at the website.

-

Joint notice with other financial institutions

You may provide a joint notice from you and one or more of your affiliates or other financial institutions, as identified in the notice, as long as the notice is accurate with respect to you and the other institutions. -

Joint relationships

If two or more consumers jointly obtain a financial product or service from you, you may satisfy the initial, annual, and revised notice requirements of §§ 313.4(a), 313.5(a), and 313.8(a) by providing one notice to those consumers jointly, unless one or more of those consumers requests separate notices.

Subpart B—Limits on Disclosures

§ 313.10 Limits on disclosure of non-public personal information to nonaffiliated third parties

-

Conditions for disclosure:

Except as otherwise authorized in this part, you may not, directly or through any affiliate, disclose any nonpublic personal information about a consumer to a nonaffiliated third party unless:- You have provided to the consumer an initial notice as required under § 313.4;

- You have provided to the consumer an opt out notice as required in § 313.7;

- You have given the consumer a reasonable opportunity, before you disclose the information to the nonaffiliated third party, to opt out of the disclosure; and

- The consumer does not opt out.

-

Opt out definition:

Opt out means a direction by the consumer that you not disclose nonpublic personal information about that consumer to a nonaffiliated third party, other than as permitted by § 313.13, 313.14, and 313.15. -

Examples of reasonable opportunity to opt out:

You provide a consumer with a reasonable opportunity to opt out if:- By mail:

You mail the notices required to the consumer and allow the consumer to opt out by mailing a form, calling a toll-free telephone number, or any other reasonable means within 30 days from the date you mailed the notices. - By electronic means:

A customer opens an online account with you and agrees to receive the notices electronically, and you allow the customer to opt out within 30 days after acknowledging receipt of the notices. - Isolated transaction with consumer:

For an isolated transaction, such as the purchase of a money order, you provide the notices at the time of the transaction and request the consumer to decide whether to opt out before completing the transaction.

- By mail:

§ 313.11 Limits on redisclosure and reuse of information

-

Information you receive under an exception:

If you receive nonpublic personal information from a nonaffiliated financial institution under an exception in § 313.14 or § 313.15, your disclosure and use of that information is limited as follows:- You may disclose the information to the affiliates of the financial institution from which you received the information;

- You may disclose the information to your affiliates, but they may disclose and use the information only to the extent you may disclose and use it; and

- You may disclose and use the information under an exception in § 313.14 or § 313.15 in the ordinary course of business.

Example:

If you receive a customer list for account processing services under the exception in § 313.14(a), you may disclose that information under an exception in § 313.14 or § 313.15, but not for marketing purposes. -

Information you receive outside of an exception:

If you receive nonpublic personal information from a nonaffiliated financial institution outside an exception, you may disclose the information only:- To the affiliates of the financial institution;

- To your affiliates, but they may disclose the information only as you are allowed to; and

- To any other person, if it would be lawful for the financial institution to disclose it directly.

Example:

If you buy a customer list outside the exceptions in § 313.14 and 313.15, you may use the list for your purposes but disclose it only under the financial institution’s privacy policy or with a consumer’s opt-out consent. -

Information you disclose under an exception:

If you disclose nonpublic personal information to a nonaffiliated third party under an exception in § 313.14 or § 313.15, the third party may disclose and use the information only: -

Information you disclose outside of an exception:

If you disclose nonpublic personal information to a nonaffiliated third party outside an exception, the third party may disclose the information only:- To your affiliates;

- To its affiliates, but only to the extent the third party may disclose it; and

- To any other person, if it would be lawful if you disclosed it directly to that person.

§ 313.12 Limits on sharing account number information for marketing purposes

-

General prohibition on disclosure of account numbers:

You must not, directly or through an affiliate, disclose, other than to a consumer reporting agency, an account number or similar form of access number or access code for a consumer's credit card account, deposit account, or transaction account to any nonaffiliated third party for use in:- Telemarketing,

- Direct mail marketing, or

- Other marketing through electronic mail to the consumer.

-

Exceptions:

The general prohibition does not apply if you disclose an account number or similar form of access number or access code:- To your agent or service provider solely in order to perform marketing for your own products or services, as long as the agent or service provider is not authorized to directly initiate charges to the account; or

- To a participant in a private label credit card program or an affinity or similar program where the participants in the program are identified to the customer when the customer enters into the program.

-

Examples:

- Account number:

An account number, or similar form of access number or access code, does not include a number or code in an encrypted form, as long as you do not provide the recipient with a means to decode the number or code. - Transaction account:

A transaction account is an account other than a deposit account or a credit card account. A transaction account does not include an account to which third parties cannot initiate charges.

- Account number:

Subpart C—Exceptions

§ 313.13 Exception to opt out requirements for service providers and joint marketing

-

General rule:

- The opt-out requirements in §§ 313.7 and 313.10 do not apply when you provide nonpublic personal information to a nonaffiliated third party to perform services for you or functions on your behalf, if you:

- Provide the initial notice in accordance with § 313.4; and

- Enter into a contractual agreement with the third party that prohibits the third party from disclosing or using the information other than to carry out the purposes for which you disclosed the information, including use under an exception in § 313.14 or § 313.15 in the ordinary course of business to carry out those purposes.

- Example:

If you disclose nonpublic personal information under this section to a financial institution with which you perform joint marketing, your contractual agreement with that institution meets the requirements of paragraph (a)(1)(ii) of this section if it prohibits the institution from disclosing or using the nonpublic personal information except as necessary to carry out the joint marketing or under an exception in § 313.14 or § 313.15 in the ordinary course of business to carry out that joint marketing.

- The opt-out requirements in §§ 313.7 and 313.10 do not apply when you provide nonpublic personal information to a nonaffiliated third party to perform services for you or functions on your behalf, if you:

-

Service may include joint marketing:

The services a nonaffiliated third party performs for you under paragraph (a) of this section may include marketing of your own products or services or marketing of financial products or services offered pursuant to joint agreements between you and one or more financial institutions. -

Definition of joint agreement:

For purposes of this section, joint agreement means a written contract pursuant to which you and one or more financial institutions jointly offer, endorse, or sponsor a financial product or service.

§ 313.14 Exceptions to Notice and Opt Out Requirements for Processing and Servicing Transactions

-

Exceptions for Processing Transactions at Consumer’s Request:

The requirements for initial notice in § 313.4(a)(2), opt-out in §§ 313.7 and 313.10, and for service providers and joint marketing in § 313.13 do not apply if you disclose nonpublic personal information as necessary to effect, administer, or enforce a transaction that a consumer requests or authorizes, or in connection with:- Servicing or processing a financial product or service that a consumer requests or authorizes;

- Maintaining or servicing the consumer’s account with you, or with another entity as part of a private label credit card program or other extension of credit on behalf of such entity;

- A proposed or actual securitization, secondary market sale (including sales of servicing rights), or similar transaction related to a transaction of the consumer.

-

Necessary to Effect, Administer, or Enforce a Transaction

Disclosure is considered necessary if it is:- Required or is a lawful or appropriate method to enforce your rights or the rights of others engaged in the financial transaction or providing the product or service;

- Required or is a usual, appropriate, or acceptable method:

- To carry out the transaction or the business associated with the product or service, and record, service, or maintain the consumer's account as part of providing the financial service or product;

- To administer or service benefits or claims relating to the transaction or associated product or service;

- To provide confirmation, statements, or other transaction records, or to report on the status or value of the product or service to the consumer or their agent;

- To accrue or recognize incentives or bonuses associated with the transaction provided by you or any other party;

- To underwrite insurance at the consumer's request or for reinsurance purposes, or for other purposes as related to a consumer’s insurance, such as account administration, fraud prevention, premium processing, claims processing, administering benefits, research, or as otherwise permitted by law;

- In connection with:

- Authorization, settlement, billing, processing, clearing, or collection of amounts charged, debited, or paid using a payment method such as a debit, credit, or other payment card, check, or account number;

- Transfer of receivables, accounts, or interests;

- Audit of debit, credit, or other payment information.

§ 313.15 Other Exceptions to Notice and Opt Out Requirements

-

Exceptions to Opt Out Requirements

The requirements for initial notice in § 313.4(a)(2), for opt-out in §§ 313.7 and 313.10, and for service providers and joint marketing in § 313.13 do not apply when you disclose nonpublic personal information:- With the consent or at the direction of the consumer, provided the consumer has not revoked consent or direction;

- To:

- Protect the confidentiality or security of your records related to the consumer, service, product, or transaction;

- Protect against or prevent fraud, unauthorized transactions, claims, or other liability;

- Conduct required institutional risk control or resolve consumer disputes or inquiries;

- Persons holding a legal or beneficial interest relating to the consumer; or

- Persons acting in a fiduciary or representative capacity on behalf of the consumer;

- To provide information to insurance rate advisory organizations, guaranty funds or agencies, rating agencies, industry compliance assessors, and your attorneys, accountants, and auditors;

- As permitted or required by law, including under the Right to Financial Privacy Act of 1978 (12 U.S.C. 3401 et seq.), and to law enforcement agencies, federal regulators, the Secretary of the Treasury (for financial recordkeeping purposes), state insurance authorities, the Federal Trade Commission, self-regulatory organizations, or for investigations related to public safety;

- To a consumer reporting agency in accordance with the Fair Credit Reporting Act (15 U.S.C. 1681 et seq.), or based on information from a consumer report;

- In connection with a proposed or actual sale, merger, transfer, or exchange of a business or unit, as long as the nonpublic personal information pertains only to consumers of that business or unit;

- To:

- Comply with federal, state, or local laws, rules, and legal requirements;

- Respond to authorized civil, criminal, or regulatory investigations, subpoenas, or summonses by federal, state, or local authorities;

- Respond to judicial processes or government regulatory authorities with jurisdiction for examination, compliance, or other legally authorized purposes.

-

Examples of Consent and Revocation of Consent

- A consumer may specifically consent to your disclosing that the consumer applied for a mortgage to a nonaffiliated insurance company, allowing the insurance company to offer homeowner's insurance.

- A consumer may revoke consent by subsequently opting out of future disclosures of nonpublic personal information, as permitted under § 313.7(f).

[65 FR 33677, May 24, 2000, as amended at 86 FR 70026, Dec. 9, 2021]

Subpart D—Relation to Other Laws; Effective Date

§ 313.16 Protection of Fair Credit Reporting Act

Nothing in this part shall be construed to modify, limit, or supersede the operation of the Fair Credit Reporting Act (15 U.S.C. 1681 et seq.), and no inference shall be drawn on the basis of the provisions of this part regarding whether information is transaction or experience information under section 603 of that Act.

§ 313.17 Relation to State laws

-

In general

This part shall not be construed as superseding, altering, or affecting any statute, regulation, order, or interpretation in effect in any State, except to the extent that such State statute, regulation, order, or interpretation is inconsistent with the provisions of this part, and then only to the extent of the inconsistency. -

Greater protection under State law

For purposes of this section, a State statute, regulation, order, or interpretation is not inconsistent with the provisions of this part if the protection such statute, regulation, order, or interpretation affords any consumer is greater than the protection provided under this part, as determined by the Commission on its own motion or upon the petition of any interested party, after consultation with the applicable federal functional regulator or other authority.

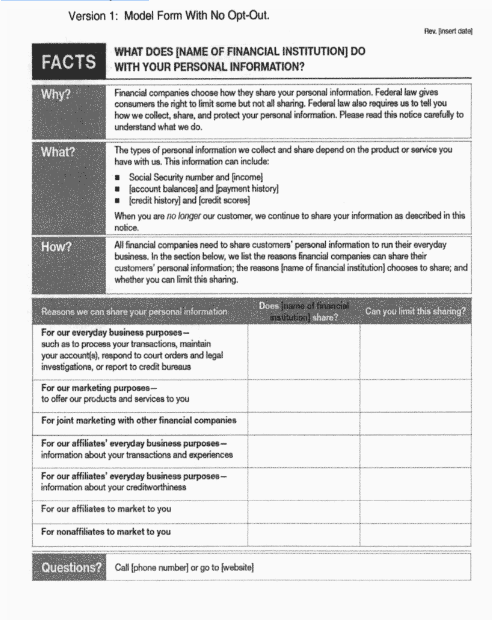

Appendix A to Part 313—Model Privacy Form

A. The Model Privacy Form

1. How the Model Privacy Form is Used

-

The model form may be used, at the option of a financial institution, including a group of financial institutions that use a common privacy notice, to meet the content requirements of the privacy notice and opt-out notice set forth in §§ 313.6 and 313.7 of this part.

-

The model form is a standardized form, including page layout, content, format, style, pagination, and shading. Institutions seeking to obtain the safe harbor through use of the model form may modify it only as described in these Instructions.

-

Note that disclosure of certain information, such as assets, income, and information from a consumer reporting agency, may give rise to obligations under the Fair Credit Reporting Act [15 U.S.C. 1681-1681x] (FCRA), such as a requirement to permit a consumer to opt out of disclosures to affiliates or designation as a consumer reporting agency if disclosures are made to nonaffiliated third parties.

-

The word “customer” may be replaced by the word “member” whenever it appears in the model form, as appropriate.

2. The Contents of the Model Privacy Form

The model form consists of two pages, which may be printed on both sides of a single sheet of paper, or may appear on two separate pages. Where an institution provides a long list of institutions at the end of the model form in accordance with Instruction C.3(a)(1), or provides additional information in accordance with Instruction C.3(c), and such list or additional information exceeds the space available on page two of the model form, such list or additional information may extend to a third page.

-

Page One: The first page consists of the following components:

- Date last revised (upper right-hand corner).

- Title.

- Key frame (Why?, What?, How?).

- Disclosure table (“Reasons we can share your personal information”).

- “To limit our sharing” box, as needed, for the financial institution's opt-out information.

- “Questions” box, for customer service contact information.

- Mail-in opt-out form, as needed.

-

Page Two: The second page consists of the following components:

- Heading (Page 2).

- Frequently Asked Questions (“Who we are” and “What we do”).

- Definitions.

- “Other important information” box, as needed.

3. The Format of the Model Privacy Form

The format of the model form may be modified only as described below.

-

Easily readable type font: Financial institutions that use the model form must use an easily readable type font. While a number of factors together produce an easily readable type font, institutions are required to use a minimum of 10-point font (unless otherwise expressly permitted in these Instructions) and sufficient spacing between the lines of type.

-

Logo: A financial institution may include a corporate logo on any page of the notice, so long as it does not interfere with the readability of the model form or the space constraints of each page.

-

Page size and orientation: Each page of the model form must be printed on paper in portrait orientation, the size of which must be sufficient to meet the layout and minimum font size requirements, with sufficient white space on the top, bottom, and sides of the content.

-

Color: The model form must be printed on white or light color paper (such as cream) with black or other contrasting ink color. Spot color may be used to achieve visual interest, so long as the color contrast is distinctive and the color does not detract from the readability of the model form. Logos may also be printed in color.

-

Languages: The model form may be translated into languages other than English.

C. Information Required in the Model Privacy Form

The information in the model form may be modified only as described below:

1. Name of the Institution or Group of Affiliated Institutions Providing the Notice

Insert the name of the financial institution providing the notice or a common identity of affiliated institutions jointly providing the notice on the form wherever [name of financial institution] appears.

2. Page One

-

Last revised date.

- The financial institution must insert in the upper right-hand corner the date on which the notice was last revised. The information shall appear in minimum 8-point font as “rev. [month/year]” using either the name or number of the month, such as “rev. July 2009” or “rev. 7/09”.

-

General instructions for the “What?” box.

- The bulleted list identifies the types of personal information that the institution collects and shares. All institutions must use the term “Social Security number” in the first bullet.

- Institutions must use five (5) of the following terms to complete the bulleted list: income; account balances; payment history; transaction history; transaction or loss history; credit history; credit scores; assets; investment experience; credit-based insurance scores; insurance claim history; medical information; overdraft history; purchase history; account transactions; risk tolerance; medical-related debts; credit card or other debt; mortgage rates and payments; retirement assets; checking account information; employment information; wire transfer instructions.

-

General instructions for the disclosure table.

- The left column lists reasons for sharing or using personal information. Each reason correlates to a specific legal provision described in paragraph C.2(d) of this Instruction.

- In the middle column, each institution must provide a “Yes” or “No” response that accurately reflects its information-sharing policies and practices.

- In the right column, each institution must provide one of the following three (3) responses as applicable: “Yes” (if an opt-out is provided); “No” (if no opt-out is provided); or “We don’t share” (if “No” is in the middle column). Only the sixth row (“For our affiliates to market to you”) may be omitted at the institution's option.

-

Specific disclosures and corresponding legal provisions.

-

For our everyday business purposes.

-

For our marketing purposes.

- This reason incorporates sharing information with service providers by an institution for its own marketing pursuant to § 313.13 of this part. An institution that shares for this reason may choose to provide an opt-out.

-

For joint marketing with other financial companies.

- This reason incorporates sharing information under joint marketing agreements between two or more financial institutions and with any service provider used in connection with such agreements pursuant to § 313.13 of this part. An institution that shares for this reason may choose to provide an opt-out.

-

For our affiliates' everyday business purposes—information about transactions and experiences.

- This reason incorporates sharing information specified in sections 603(d)(2)(A)(i) and (ii) of the FCRA. An institution that shares for this reason may choose to provide an opt-out.

-

For our affiliates' everyday business purposes—information about creditworthiness.

- This reason incorporates sharing information pursuant to section 603(d)(2)(A)(iii) of the FCRA. An institution that shares for this reason must provide an opt-out.

-

For our affiliates to market to you.

- This reason incorporates sharing information specified in section 624 of the FCRA. This reason may be omitted from the disclosure table when: the institution does not have affiliates (or does not disclose personal information to its affiliates); the institution's affiliates do not use personal information in a manner that requires an opt-out; or the institution provides the affiliate marketing notice separately. Institutions that include this reason must provide an opt-out of indefinite duration. An institution that is required to provide an affiliate marketing opt-out, but does not include that opt-out in the model form under this part, must comply with section 624 of the FCRA and 16 CFR parts 680 and 698 with respect to the initial notice and opt-out and any subsequent renewal notice and opt-out. An institution not required to provide an opt-out under this subparagraph may elect to include this reason in the model form.

-

For nonaffiliates to market to you.

- This reason incorporates sharing described in §§ 313.7 and 313.10(a) of this part. An institution that shares personal information for this reason must provide an opt-out.

-

-

To limit our sharing:

- A financial institution must include this section of the model form only if it provides an opt-out. The word “choice” may be written in either the singular or plural, as appropriate. Institutions must select one or more of the applicable opt-out methods described: telephone, such as by a toll-free number; a Web site; or use of a mail-in opt-out form. Institutions may include the words “toll-free” before telephone, as appropriate. An institution that allows consumers to opt out online must provide either a specific Web address that takes consumers directly to the opt-out page or a general Web address that provides a clear and conspicuous direct link to the opt-out page. The opt-out choices made available to the consumer who contacts the institution through these methods must correspond accurately to the “Yes” responses in the third column of the disclosure table. In the part titled “Please note” institutions may insert a number that is 30 or greater in the space marked “[30].” Instructions on voluntary or state privacy law opt-out information are in paragraph C.2(g)(5) of these Instructions.

-

Questions box.

- Customer service contact information must be inserted as appropriate, where

[phone number]or[Web site]appear. Institutions may elect to provide either a phone number, such as a toll-free number, or a Web address, or both. Institutions may include the words “toll-free” before the telephone number, as appropriate.

- Customer service contact information must be inserted as appropriate, where

-

Mail-in opt-out form.

-

Financial institutions must include this mail-in form only if they state in the “To limit our sharing” box that consumers can opt out by mail. The mail-in form must provide opt-out options that correspond accurately to the “Yes” responses in the third column in the disclosure table. Institutions that require customers to provide only name and address may omit the section identified as

[account #]. Institutions that require additional or different information, such as a random opt-out number or a truncated account number, to implement an opt-out election should modify the[account #]reference accordingly. This includes institutions that require customers with multiple accounts to identify each account to which the opt-out should apply. An institution must enter its opt-out mailing address in the far right of this form (see version 3); or below the form (see version 4). The reverse side of the mail-in opt-out form must not include any content of the model form. -

Joint accountholder.

- Only institutions that provide their joint accountholders the choice to opt out for only one accountholder, in accordance with paragraph C.3(a)(5) of these Instructions, must include in the far left column of the mail-in form the following statement: “If you have a joint account, your choice(s) will apply to everyone on your account unless you mark below. □ Apply my choice(s) only to me.” The word “choice” may be written in either the singular or plural, as appropriate. Financial institutions that provide insurance products or services, provide this option, and elect to use the model form may substitute the word “policy” for “account” in this statement. Institutions that do not provide this option may eliminate this left column from the mail-in form.

-

FCRA Section 603(d)(2)(A)(iii) opt-out.

- If the institution shares personal information pursuant to section 603(d)(2)(A)(iii) of the FCRA, it must include in the mail-in opt-out form the following statement: “□ Do not share information about my creditworthiness with your affiliates for their everyday business purposes.”

-

FCRA Section 624 opt-out.

- If the institution incorporates section 624 of the FCRA in accord with paragraph C.2(d)(6) of these Instructions, it must include in the mail-in opt-out form the following statement: “□ Do not allow your affiliates to use my personal information to market to me.”

-

Nonaffiliate opt-out.

- If the financial institution shares personal information pursuant to § 313.10(a) of this part, it must include in the mail-in opt-out form the following statement: “□ Do not share my personal information with nonaffiliates to market their products and services to me.”

-

Additional opt-outs.

- Financial institutions that use the disclosure table to provide opt-out options beyond those required by Federal law must provide those opt-outs in this section of the model form. A financial institution that chooses to offer an opt-out for its own marketing in the mail-in opt-out form must include one of the two following statements: “□ Do not share my personal information to market to me.” or “□ Do not use my personal information to market to me.” A financial institution that chooses to offer an opt-out for joint marketing must include the following statement: “□ Do not share my personal information with other financial institutions to jointly market to me.”

-

-

Barcodes.

- A financial institution may elect to include a barcode and/or “tagline” (an internal identifier) in 6-point font at the bottom of page one, as needed for information internal to the institution, so long as these do not interfere with the clarity or text of the form.

3. Page Two

- General Instructions for the Questions. Certain of the Questions may be customized as follows:

-

"Who is providing this notice?"

- This question may be omitted where only one financial institution provides the model form and that institution is clearly identified in the title on page one. Two or more financial institutions that jointly provide the model form must use this question to identify themselves as required by § 313.9(f) of this part. Where the list of institutions exceeds four (4) lines, the institution must describe in the response to this question the general types of institutions jointly providing the notice and must separately identify those institutions, in minimum 8-point font, directly following the "Other important information" box, or, if that box is not included in the institution's form, directly following the "Definitions." The list may appear in a multi-column format.

-

"How does [name of financial institution] protect my personal information?"

- The financial institution may only provide additional information pertaining to its safeguards practices following the designated response to this question. Such information may include information about the institution's use of cookies or other measures it uses to safeguard personal information. Institutions are limited to a maximum of 30 additional words.

-

"How does [name of financial institution] collect my personal information?"

- Institutions must use five (5) of the following terms to complete the bulleted list for this question: Open an account; deposit money; pay your bills; apply for a loan; use your credit or debit card; seek financial or tax advice; apply for insurance; pay insurance premiums; file an insurance claim; seek advice about your investments; buy securities from us; sell securities to us; direct us to buy securities; direct us to sell your securities; make deposits or withdrawals from your account; enter into an investment advisory contract; give us your income information; provide employment information; give us your employment history; tell us about your investment or retirement portfolio; tell us about your investment or retirement earnings; apply for financing; apply for a lease; provide account information; give us your contact information; pay us by check; give us your wage statements; provide your mortgage information; make a wire transfer; tell us who receives the money; tell us where to send the money; show your government-issued ID; show your driver's license; order a commodity futures or option trade.